It is increasingly accepted that China’s consumption is underestimated, while its investment is overestimated. Two studies, among others, have shed light on the subject. One is on unreported ‘grey’ income by Professor Wang Xiaolu of the National Economic Research Institute; the other is on consumption underestimation by Professors Zhang Jun of Fudan University and Zhu Tian of the China-Europe Business School. Many have heard of these studies, but most believe that the difference is insignificant.

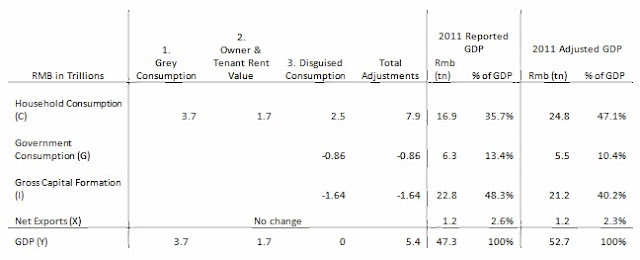

By combining the results of the two studies, however, my conclusions show very significant changes to China’s GDP composition. The corrections would raise household consumption by 11 per cent of GDP, while reducing the shares of investment and government spending by 8 per cent and 3 per cent of GDP, respectively.

Even that only brings consumption from 36 per cent to 47 per cent, still a long way away from desirable. But the implication is profound: it would mean that China need not be so aggressive in slowing investment and that it has less scope than previously believed to stimulate consumption.

Read more »![]()

By combining the results of the two studies, however, my conclusions show very significant changes to China’s GDP composition. The corrections would raise household consumption by 11 per cent of GDP, while reducing the shares of investment and government spending by 8 per cent and 3 per cent of GDP, respectively.

Even that only brings consumption from 36 per cent to 47 per cent, still a long way away from desirable. But the implication is profound: it would mean that China need not be so aggressive in slowing investment and that it has less scope than previously believed to stimulate consumption.

Read more »